Air cargo capacity crosses pre-Covid-19 levels for the first time

The strong uptick is driven by belly capacity as demand in the passenger business recovers. Freighter capacity declined 2.3%.

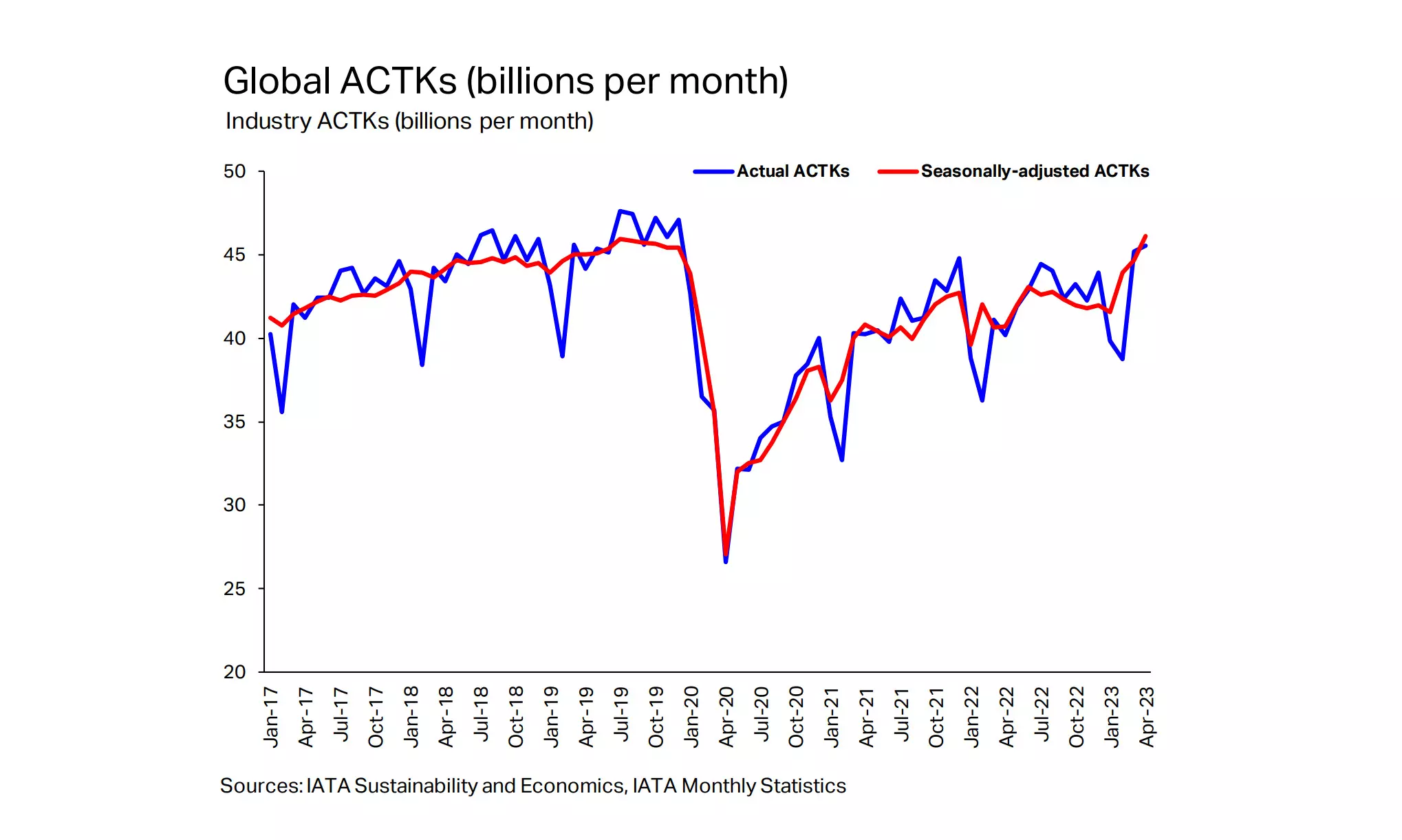

The International Air Transport Association (IATA) released data for April 2023 global air cargo markets, showing capacity (measured in available cargo tonne-kilometers, ACTK) was up 13.4 percent compared to April 2022 and 3.2 percent compared to April 2019, marking the first time in three years that the capacity has surpassed pre-COVID levels.

“The strong uptick is primarily driven by belly capacity as demand in the passenger business recovers. Adjusting for this, freighter capacity declined 2.3 percent. Preighter operations ceased in March after 2.5 years of continuous activity,” reads the release.

Willie Walsh, IATA’s Director General, said, "The air cargo industry is adjusting itself to the implications of the recovery in passenger demand that brings with it an expansion of belly capacity. Preighter operations stopped in March and freighter services were scaled back by 2.3 percent in April.”

In April 2023 global air cargo markets also showed a continued, but slower, decline against the previous year’s demand performance. Global demand, measured in cargo tonne-kilometers (CTKs), fell 6.6 percent compared to April 2022 (-7.0 percent for international operations). This decline was an improvement over the previous month's performance (-7.6 percent).

The global new export orders component of the Purchasing Managers' Index (PMI), a leading indicator of cargo demand, improved in April. China’s PMI level surpassed the critical 50-mark indicating that demand for manufactured goods from the world’s largest export economy is growing.

Global goods trade increased by 0.2 percent in March, marking the first annual increase since November 2022.

Consumer and producer prices increases have moderated. The April headline Consumer Price Index (CPI) recorded rates of 5.0 percent in the US, 0.3 percent in China, and 3.5 percent in Japan. While Europe was higher (8.1 percent), it is well below its 11.5 percent October 2022 peak.

“The demand environment is challenging to read. Tapering inflation is definitely a positive. But the degree and speed at which that could lead to looser monetary policies that might stimulate demand is unclear. The resilience that got the air cargo industry through the COVID-19 crisis is also critical in the aftermath,” added Walsh.

Regional Performance

Asia-Pacific airlines saw their air cargo volumes decrease by 0.4 percent in April 2023 compared to the same month in 2022. This was a significant improvement in performance compared to March (-6.8 percent). Available capacity in the region increased by 41.2 percent compared to April 2022 as more and more belly capacity came online from the passenger side of the business.

North American carriers saw the weakest performance of all regions with a 13.1 percent decrease in cargo volumes in April 2023 compared to the same month in 2022. This was a drop in performance compared to March (-10.2 percent). Notably, airlines in the region saw a significant decrease in international demand in April due to a substantial fall in volumes on two major trade lanes: North America-Europe (-13.5 percent) and North America-Asia (-9.3 percent). Capacity decreased 1.5 percent compared to April 2022.

European carriers experienced an 8.2 percent decrease in cargo volumes in April 2023 compared to the same month in 2022. This was a slight decline in performance compared to March (-7.4 percent). Airlines in the region saw a significant decrease in international demand due to double-digit contractions on the North America-Europe (-13.5 percent) trade lane, as well as within Europe (-16.1 percent). This was partially offset by strong demand on the Europe-Asia route (3.4 percent), which helped mitigate the overall decline in the region. Capacity increased 7.8 percent in April 2023 compared to April 2022.

Middle Eastern carriers experienced a 6.8 percent year-on-year decrease in cargo volumes in April 2023. This was a slight decline in performance compared to the previous month (-5.5 percent). Capacity increased 10.0 percent compared to April 2022.

Latin American carriers reported a 1.6 percent decrease in cargo volumes in April 2023 compared to April 2022. This was an improvement in performance compared to March (-4.4 percent). Capacity in April was up 8.1 percent compared to the same month in 2022.

African airlines had the only positive performance in April posting a 0.9 percent increase in demand compared to April 2022. This was an improvement in performance compared to the previous month (-4.3 percent). Notably, the Africa to Asia trade route experienced a significant increase in cargo demand in April, up 20.0 percent year-on-year. Capacity was 5.3 percent above April 2022 levels.